Diving into entrepreneurship can be daunting for a number of reasons – not least of which is that even if you have a great idea, you need capital to make it happen. Startups need funding and the process of finding investors, negotiating terms and growing company valuation can be an unfamiliar prospect for many would-be founders.

Understanding how the startup funding process works can be confusing – breaking news stories about successful funding rounds and IPOs seem to assume readers already know how the system works, offering little insight into the mechanics behind it.

But unique funding models are becoming more common, and resources for budding founders and investors are becoming more accessible – there are even matchmaking sites for investors and companies!

Below, we’ve laid out funding pathways available to startups that help fuel their journey to success.

Seed Funding

Seed Funding is the initial pool of money from which a startup can fund product development, market research, marketing, or any other of the costs of getting an operation off the ground – that could mean equipment, office space, wages and more. Occasionally preceded by pre-seed funding, which is usually money the founders spend as they’re forming the initial steps of their venture, this first milestone in funding sets up the business for growth and, ideally, sets up the functions that will eventually be the company’s income streams.

Money to cover the initial expenses for a company can be tough to obtain, as traditional business lenders usually require a successful track record – new companies and founders simply can’t provide that. That’s where seed funding comes in. Seed funding is money raised from angel investors, friends and family, or pulled from the founder’s own funds – often in exchange for some form of equity, like company shares. Startup incubators and accelerators may also offer seed funding to new companies.

What are Angel Investors?

Angel investors are individuals who use their own personal funds to invest in new ventures. Their support doesn’t necessarily mean they take any operational role or voting rights in the company, making them a great option for entrepreneurs who already have a roadmap in place. And these angel investors can come from many places – they may have venture capitalism backgrounds, be part of an angel network, be independently wealthy, or may simply be a successful member of your community or industry who is looking for investment opportunities.

VC Funding Rounds

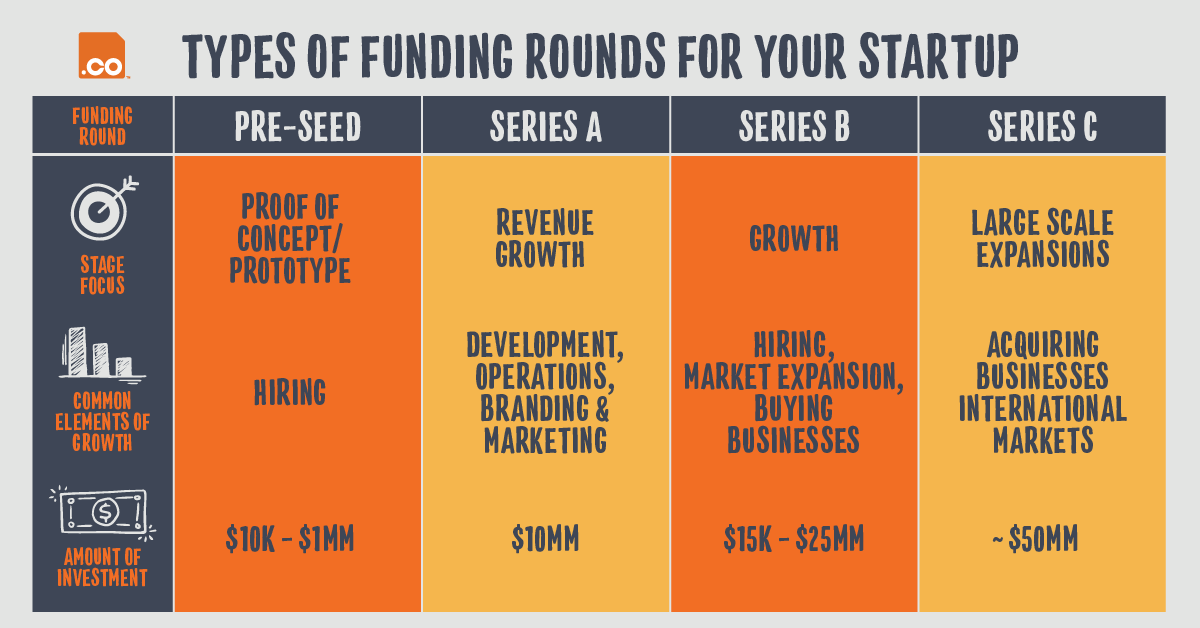

For startups that make it past the seed funding phase, VC Funding Rounds are a more formal, technical stage of raising capital. By now, the company should have an updated valuation, some proof of concept and the data to not only support it, but also project its potential – that means usable data on costs and sale values, market research, as well as an analysis on how much they were able to accomplish with the initial seed funding. And, of course, the pitch.

Seed funding angel investors may want to make a second investment in Series A, but venture capitalists – and other pro investors like private equity firms and corporate venture arms – become more accessible when startups reach Series funding. VCs want to see that the money they lend is going to have real returns, and that the company is on a good track to seeing that happen smoothly and quickly. In return for their financing, these investors typically receive equity and shares in the company.

Founders can think of each series of funding as representing company milestones.

Series A – Company is likely to be building operations that can scale up, and polishing the systems and products developed in the seed round. The company is now inching closer and closer to a final product and actual sales.

Series B – Milestones generally center around scaling, entering into new markets, and expanding teams within the company.

Series C – Generally means the startup is doing quite well and looking for greater expansion or even its own acquisitions. At this stage, a majority of the investors are likely repeat backers from previous rounds, and company valuation is likely in the tens of millions.

Most startups must complete three rounds of series funding before they can seek out an initial public offering (IPO), in which the public can buy shares on the stock market. This process is regulated by the Securities and Exchange Commission (SEC), which lays out specific requirements for companies to meet before they’re available for public trading.

Don’t Forget Crowdfunding

Crowdfunding through online platforms like Kickstarter and GoFundMe have become an accessible way for just about anyone with a good idea to bring it into reality, or gain some traction and eyeballs to their ideas and inventions. Crowdfunding allows any individual to contribute to a pool of capital – on these platforms, the founders usually set fundraising target “goals” ranging from a few thousand to several million. In return, the fledgling companies usually give supporters something in exchange, be it a small “thank you,” branded merchandise, custom products, production credits and more.

Often, crowdfunding works to fund a limited-production run of a new product, and may even fund a portion of the prototyping phase of product development. Those who contribute to the crowdfunding campaign could wait months or even years to receive their incentives (i.e. the perks promised for each tier of funding), but will also be given a window into the development, production and distribution process.

There are many funding paths for entrepreneurs to turn their ideas into profitable companies. And in the age of rapidly-growing startups, the antiquated model of turning to traditional banks for financing is becoming a smaller piece of the startup economy.